This Week in Real Estate -10th February 2023

Students Join Qld Rent Squeeze

Thousands of Chinese international students are expected to return to Queensland and put increasing demand on the tight rental market.

With the university year set to begin in the coming weeks, it is expected many Chinese students will struggle to find accommodation.

Student Accommodation Council president Torie Brown says Brisbane’s student accommodation market is the tightest in Australia.

With a vacancy rate of just 0.8%, many are already struggling to find a home in Brisbane.

Brown says student accommodation providers are already at capacity. The growing demand means student rents have increased.

Tenants Queensland chief executive Penny Carr worries if the rental issues can’t be resolved international students will look elsewhere for their education.

“One might hope there might be a few opportunities for students to find rooms in share houses or private accommodation but for those who haven’t been to Brisbane, it’s likely to be quite difficult and stressful.”

Millennials Struggle On Coast

Rising Gold Coast property prices mean Millennial buyers are struggling to buy in popular suburbs on the glitter strip.

PropTrack economist Angus Moore says buyers aged between 26 to 42 are struggling to buy in many locations and the increase in interest rates has reduced their borrowing power.

He says in 1990 saving a 20% deposit for a median-priced home on the Gold Coast took three years, compared with six to seven years now.

“Homeownership rates among 24-to-35-year-olds are lower than they were a few decades ago, which means Millennials will have a different experience from their parents,” Moore says.

“They’ll be buying at a later point in life. They’ll be carrying debt later. So, they won’t be mortgage free as early as perhaps their parents were.”

Quote of the Week

“Many vendors don’t have the need to sell, so even if it’s a buyers’ market, there are fewer options and there’s more competition for those that are listed for sale.”

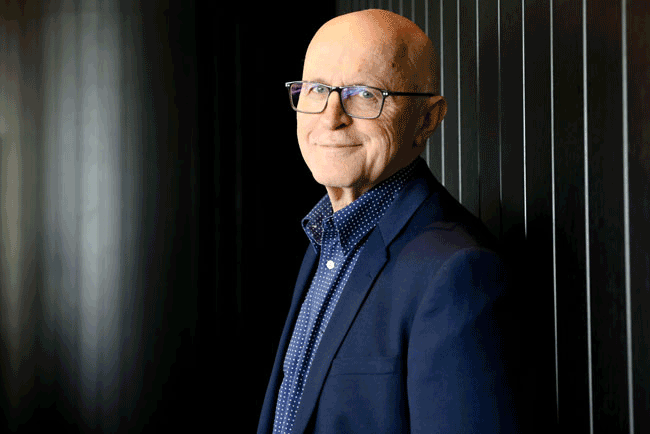

SQM Research Managing director Louis Christopher

Market Tipped To Bounce Back

Owners should feel optimistic about the future of property in Australia according to leading demographer and author Bernard Salt.

He believes the resumption of immigration to pre-pandemic levels will lead to increased demand in the property market over the next five years.

And in good news for investors, he says the tight rental market will become even tighter following an influx of migrants and overseas students, particularly from China.

According to PropTrack data, rental listings fell more than 25% in 2022 while rents rose 10% across capital cities.

SQM Research says asking rents increased in January and are now up 18% year-on-year.

Salt predicts lifestyle markets outside the major cities will continue to benefit as middle-age millennials and retiring baby boomers decided to make a move.

“The average life expectancy is 84, which is almost 20 years in retirement. Our lifecycle has been reinvented to introduce a lifestyle stage,” he says.

Millennials will move further out for larger homes to accommodate growing families.

Lenders Prep For Lower Rates

While the Reserve Bank continues to lift interest rates, lenders are already factoring in lower rates in the future.

Mortgage broker Louisa Sanghera from Zippy Financial says although interest rates are now at a decade-high of 3.35%, the lending sector is already starting to reduce some of its variable rates.

“Variable interest rates are coming down right now, plus, pricing is getting sharper and more competitive at the moment,” she says.

“Fixed rates are also a bit more stable with some lenders even reducing fixed rates at the end of last year.”

Sanghera says the variable rates on offer have dropped from 4.83% to 4.63% in recent months.

She says with retail spending down by almost 4% in December and house prices softening in the biggest cities, it is time for the RBA to stop raising rates and assess if the past nine increases have reduced inflation.

She describes the recent rate hikes as being like a “financial sledgehammer” on mortgage holders.