This Week in Real Estate – 9th April 2022

Migration To Qld Tipped To Double

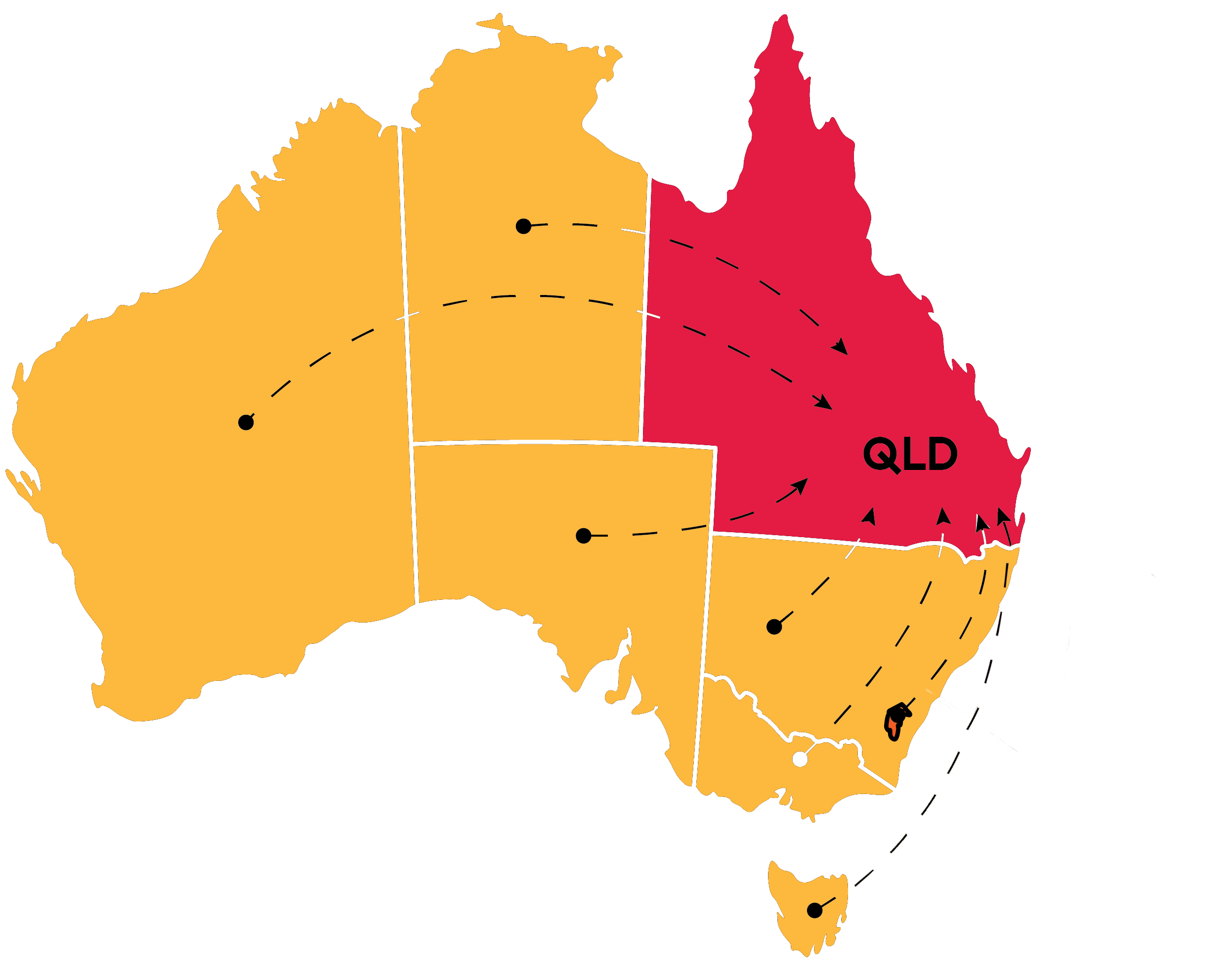

Continued high migration to Queensland, particularly from southern states, is tipped to push the population to six million people within five years.

The Federal Budget predicts 41,000 people will move to Queensland in the current financial year, almost double the increase that was predicted just a year ago.

At the same time, NSW is predicted to lose about 40,000 people, and Victoria is tipped to lose more than 17,000 people.

Real Estate Institute of Queensland chief executive Antonia Mercorella says the growing population will lead to increased demand for housing at a time of delays and shortages. She says it will be a challenge for governments to ensure housing and infrastructure keep pace with the predicted population growth.

According to University of Queensland human geography lecturer Elin Charles-Edwards, the last time migration was so high was in the early 2000s.

“It’s mostly concentrated in the south-east corner of the state,” Charles-Edwards says.

“Where one place is losing, it’s usually to Queensland’s net benefit.”

Surge In Qld Million-Dollar Suburbs

The number of Queensland homes selling for more than $1 million has increased tenfold since 2011.

CoreLogic figures show 10,514 homes in Brisbane sold for $1 million or more in the year to December 2021.

Brisbane now has 15 suburbs where every sale is over $1 million, up from five suburbs in 2011.

The figures show 28 suburbs in the Brisbane region had 80% of sales for more than $1million in 2021, up from six suburbs ten years earlier.

The results aren’t isolated to the capital city, with Regional Queensland recording 17 suburbs where all sales were for more than $1million.

These included Cooroy Mountain, Kiama, The Keppels, Orange Hills, North Gregory and Kidaman Creek.

CoreLogic head of research Tim Lawless says Queensland prices had increased “spectacularly”.

“We will see more and more bracket creep as more properties get pushed over $1million,” he says.

While price growth seems unending, Lawless says within the next 12 months it will not be as strong in some areas.

House Prices Rising In Most Markets

Price growth is continuing in most markets across Australia, with the latest CoreLogic figures revealing an 0.7% national increase in dwelling values in March, up from 0.6% in February.

Growth in house prices is being led by the smaller capital cities, notably Brisbane and Adelaide, and the regional markets – with Sydney and Melbourne showing small decreases in March.

The highest March growth occurred in Regional South Australia (2.9%), Regional Queensland (2.0%), Brisbane (2.1%), Adelaide (2.0%) and Regional NSW (1.8%).

There was also growth in apartment markets, with 14 of the 15 markets (eight capital cities and seven state regional markets) recording increases in median prices in March, led by Regional WA (2.5%) and Regional Queensland (2.2%).

In the March Quarter, six markets – Brisbane, Adelaide and the Regional areas of NSW, Qld, South Australia and Tasmania – grew their house prices by 5% or more. In annual terms,Sydney, Brisbane, Adelaide, Hobart, Canberra and Regional NSW, Victoria, Qld and Tasmania have all risen 20% plus.

Rental Shortage Crisis Gets Worse

It’s become even harder to find a rental property, with new data from Domain revealing the national vacancy rate hit a record low 1% in March.

Vacancies fell in five of the capital cities during the month, while they increased slightly in Hobart and held steady in Perth.

Domain’s analysis shows Adelaide’s vacancy rate of 0.2% is the lowest vacancy rate ever to be recorded across any capital city since it began keeping records.

Canberra, Darwin and Perth have all time low vacancy rates of 0.5%. Sydney’s vacancy rate is 1.4%, Melbourne is 1.8%, Brisbane is 0.7% and Hobart is 0.3%, while most regional markets have vacancies below 1%.

Domain says Australia is well and truly in a rental crisis which looks unlikely to ease anytime soon.

It is being made worse by the reopening of international borders in recent months and natural disasters.

The reopening of borders is expected to increase demand for rental properties in Sydney and Melbourne in particular.

Migration Helps Drive New Home Sales

Renewed interest from international buyers is expected to continue to drive new home sales, now that international borders have reopened.

While new home sales have been strong in the past two years as a result of financial stimulus measures such as the HomeBuilder scheme, developers are already reporting a return of international buyers.

Nathan Blackburne of Cedar Woods told The Australian that 14% of the inquiry they received in the past month came from overseas, with interest from Britain, NZ, Malaysia, China and Hong Kong.

“Pent-up demand from overseas buyers who wanted to come here and work or study is coming through following the lifting of restrictions,” he says. “By June, we expect the data to show a strong upswing in overseas buyer numbers.”

He predicts overseas buyers, who have been effectively locked out for two years, will move faster to buy in the coming years.

Population forecasts predict overseas migration will return to pre-pandemic levels within the next two to three years.