This Week in Real Estate – 23rd September 2022

GC Population Rise Amid Housing Crisis

The Gold Coast mayor has warned the local housing shortage crisis will worsen as more people move to the region.

To help ease the pressure Mayor Tom Tate is calling for the State Government to quickly tick off on changes to the City Plan so that it can help accommodate the growing population.

Property Council figures estimate 85,000 people from Sydney and Melbourne will move to the Gold Coast within the next five years.

Queensland Property Council executive director Jen Williams says this shows that urgent action is needed to address infrastructure and housing supply issues. “We need a plan to prepare, not only to protect our enviable lifestyle but also to ensure we have the infrastructure and housing supply to support the population growth,” she says.

Tate says the Gold Coast’s efforts to tackle the housing supply issue is being frustrated by the State Government’s delay in signing off on city plan amendments which it has had since December last year.

Quote of the Week

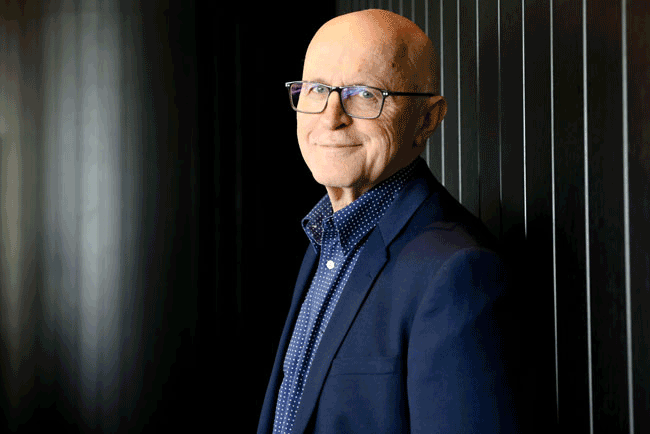

“Either people accept greater density in their suburb, or their children will not be able to buy a home, and seniors will not be able to downsize in the suburb where they live. This is a problem we can fix, but only if we make the right choices.”

– Grattan Institute economic policy director Brendan Coates

Land Values Surge On Shortage

Land prices have surged throughout Australia, with new data showing a 19.7% increase nationwide in the 12 months to March – but with some cities growing at higher rates.

Median lot prices in Hobart rose by 47%, followed by Sydney’s 43% and Melbourne’s 32%, according to the HIA’s Residential Land Report.

But senior economist Nick Ward suggests that rising construction costs and interest rates could dampen that in coming months.

“An unusually sharp rise in the price of residential land indicates the supply of land is not keeping up with new demand that has emerged during the pandemic,” Ward says.

The report shows the price of an average lot in Brisbane south, Adelaide Central and Hills district and Launceston more than doubled in the past 12 months, by 110%, 175% and 126% respectively.

The report says Sydney is the most expensive capital city for land with a median lot price of $1682 per square metre, followed by Melbourne’s $1044.

Auction Clearance Rates On The Rise

Auction clearance rates are on the rise despite increased volumes of properties for sale, with buyers active during the first weeks of the Spring selling season.

CoreLogic analysis of 1,740 auctions across capital cities last weekend shows 62.5% sold, slightly up on the previous week’s clearance rate of 60%.

Real estate economist Nerida Conisbee says her analysis of 600 weekend auctions shows there were on average four registered bidders per auction, and 2.7 active bidders.

This was up on 3.4 average registered bidders per auction the previous week.

Last weekend was the busiest auction week since late June with the number of properties being taken to auction on the rise and up 17.6% in Melbourne on the previous week and 10.5% higher in Sydney.

Brisbane had 168 homes taken to auction, in Adelaide 132 properties were offered under the hammer and 102 in Canberra.

Adelaide had the highest clearance rate of 75%, followed by Canberra 66%, Melbourne 64%, Sydney 60% and Brisbane 53%.

A Million Switch For Better Deals

As interest rates rise, the number of homeowners refinancing their mortgages continues to surge.

Australian Bureau of Statistics figures show $17.9 billion worth of loans were switched to a different lender in July, following a record $18.2 billion in June.

A survey by digital property exchange PEXA shows many owners are taking advantage of the tactic of banks to offer better interest rate deals only to new customers.

Its survey of 519 homeowners who recently refinanced, or who intend to in the next two years, shows their main motivation is to save money.

More than one million Australians refinanced last year which on average resulted in a 0.4 percentage point reduction in their mortgage interest rate, which equates to a saving of about $1,524 a year on a $610,000 loan.

The savings for owners switching to a new lender was 0.5 percentage points, while those refinancing with their existing lender only achieved rates about 0.1 percentage points lower.